Hello, aware public! So let’s know 5 such habits of saving money, which will help in improving your bank balance. That too without killing your desires. I will not brag about anything. I will not tell you to quit your job and start a business. Or start freelancing. Learn programming, improve your English communication, not all this! I will share it with you.

5 very easy, simple habits of saving money. Every student, employee, business owner, or housewife can follow and strengthen their financial position. And it is not that you have to follow all these 5 habits. If you implement even 1 or 2, then there will be changes in your life.

Who among us does not want our parents, our children, our husband or wife… all needs to be fulfilled. If children ask us for something. So we should not refuse just because there is no money in the house. We all have our own needs and desires like: a house, a car, and certain holidays that can be fulfilled.

We all have a certain bank balance. So whatever situation arises in the future. Be it education marriage or loan or illness. We will be able to fulfill all those obligations. I can call it an ‘ideal financial situation’. If you want to reach this point, Then this post is for you! In today’s post titled “Save Money With 5 Easy Habits,” we will talk about saving money…

1. Do not use credit cards unnecessarily and avoid unnecessary debt:-

Friends! Let us start with an example, which is related to one of my colleagues. He is also posted in a senior position. Actually, as a manager, yes he used to get more salary than me. But he used to live his life as if there was no tomorrow for him. As soon as he came on the 25th of the second month, he used to ask for an advance salary. We agreed with him. Now since he had spent all the money in 25 days. So how could he manage 30 to 31 days?

So again next month probably around the 20th. Then he asked for an advance salary. This continued for 2-3 months. Then our boss refused to give advance.

Then when he left the job, we found out that he had borrowed money from many of our colleagues. He had not even paid the tea vendor’s bill of Rs 5000. Well, borrowing money is not a bad thing. Provided there is a valid reason behind it. Maybe you are buying a property. Or maybe you are borrowing for business expansion. In such a situation you will have to take a loan.

Apart from this, for any reason, whether you want to buy a car or a bike, or if you want to buy an electronic gadget like an iPhone, take a loan for this only when you have a guarantee of future cash flow.

You will not only have to repay the principal amount, but you will also have to pay interest. Anyway, it is very easy to take a loan these days. People keep calling you to sell you credit cards. Open your mobile and you will find many apps; that give you instant loans. And in many places, an interest-free period is also given.

Do you know why? All these apps and credit cards are waiting for that one moment when you default and they charge you heavy interest. If we leave aside small exceptions. So the thing to note is ‘No Credit’ and no Save Money plan.

So friends this means credit cards may seem convenient, but they come with hidden traps. Many lenders profit from customers who fail to pay on time, charging heavy interest rates. Instead of relying on credit, focus on saving for the things you need. Borrow money only when it is for an important purpose, like investing in a property or expanding your business, and make sure you can handle future repayments. And by controlling all these things, you can increase the habit of saving money.

2. Track and analyze your expenses-

Do you know, in the last month, how much rice, how much detergent has been used? What was the price of petrol, when you fueled your bike/car? What was Swiggy/Zomato’s bill last month? How much was the price of tomatoes per kg last time you went to buy tomatoes? A housewife will be able to tell you some things from this. But for most of us, it will be difficult to give any number.

It will be impossible. Many times, we trust our minds too much. In such cases, our minds give us biased reports. If I ask you what item accounts for most of your expenses or especially most of your unnecessary expenses? Then your mind will definitely tell you some item.

For example, you spend a lot on eating out. I also used to think of something like this: But, for the first time when I started keeping a record of my month. Then I found out that my biggest unnecessary expense is transport, which includes Ola, Uber, and Flight Tickets. Once you know about your expenses in different heads, then it becomes easy to find ways to save money.

But for this, trust your pen, not your mind. You just have to do one thing. That is every night, before sleeping, within 2 minutes. Write down all your expenses headwise. And add them at the end of the month. For this, either you write it yourself in your diary. Or use an app. But maintain your accounts. In this way, you can save money by keeping an eye on your expenses and analyzing them.

3. Give up harmful habits that empty your wallet-

Let’s do a small calculation. If you save Rs 80 every day. How much will you save every month? Rs 2,400. How much will you save every year? Around Rs 30,000. To be precise, Rs 29,200. Now you will say, why should I save Rs 80 every month? This is the cost of 5 classic cigarettes and we easily smoke 5-6 cigarettes a day. Some people smoke even more than that.

These are the expenses caused by our bad habits and we never pay attention to it. Because they are in very small amounts. Because if you look at it from a larger perspective; from the outside. Then this amount becomes very big.

There is a saying that “drop by drop fills the pot” and similarly the pot also gets emptied drop by drop. And the financial loss due to these bad habits is still very small, but the biggest loss is to your body. To your heart and to your family. Even if we leave everything else, giving up our bad habits is completely financially sensible. By giving up our bad habits, we can save Rs 29,200 or any other amount. Now consider this saving of yours as an investment.

For example: If we check on the Stable Money App. So we are getting 8.61% interest on bank FD and 9.21% for senior citizens. If you invest your Rs 29,200 in FD at the end of the period this amount becomes Rs 34,500. So this Rs 30,000 – Rs 35,000 is not a small amount. This may be more than our salary. But this is not a small amount. If you smoke cigarettes, where does it disappear in the smoke?

You may not even notice it. And when one of these bad habits makes you sick, you will spend even more money. If you give up such bad habits, you are getting used to saving money, even if it is a small amount.

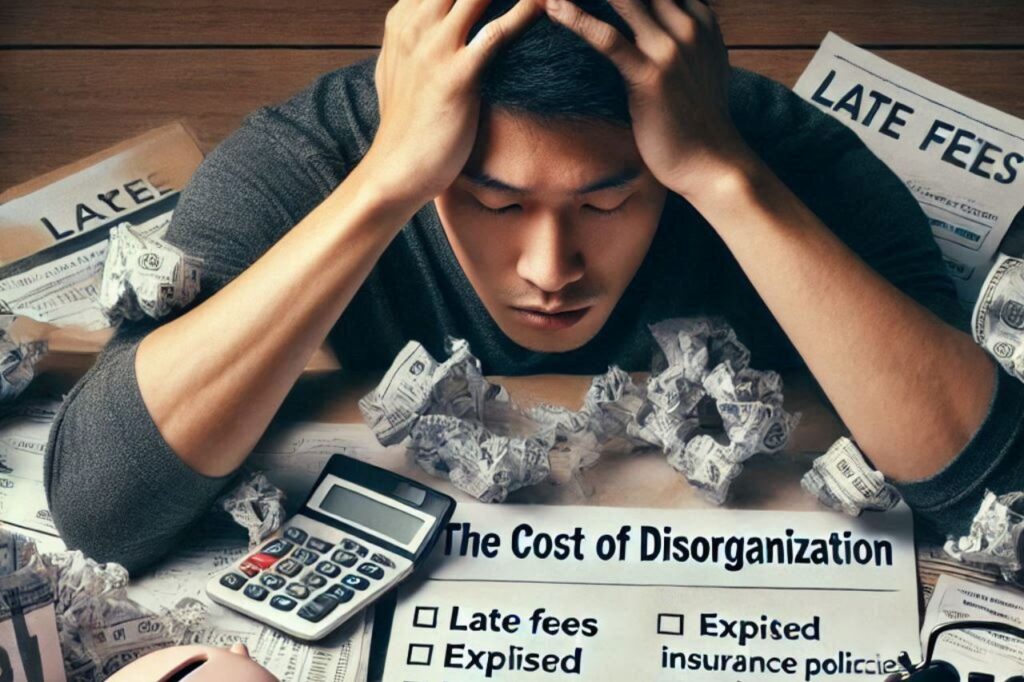

4. Keep systematic financial records:-

First of all, I have some questions for you, answer them yourself. Any of your policies, health insurance, term insurance, vehicle insurance. Has it ever expired? Because, you forgot to pay the premium on time or it so happened that you have an electronic device, that too in the warranty period. But, you are unable to find its warranty card. Electricity bill, telephone bill, advance tax, etc.

If you have not paid any of these on time and a penalty is levied, you have suffered a loss. This did not happen because you did not have the money to pay your premium or bill. It was simply because you forgot. Now who would you like to give 100% credit for this habit? Because all this happens due to not keeping systematic records. The designated file is not in the folder.

For this, you can use the calendar app or any other app. But you did not keep the correct record. If you had made a designated place or box, which would have kept all your identity cards, Aadhaar, PAN, passport, etc. If you keep all these in one place, then by doing this you will not only save your penalty fees. But, you will also save the insurance that has expired due to your mistake. This will be useful to you when needed. Meaning, that if we keep a correct record of all the financial things, then apart from saving the penalty, we will be able to save money.

5. Avoid spending money on brands for social acceptance:-

Many people fall into the trap of buying expensive branded items, hoping they will earn social recognition. However, the real value lies in practicality and personal satisfaction, not in logos. Even some of the wealthiest individuals prefer functionality over flashy brands. The focus should be on building your legacy and identity rather than relying on material possessions to define yourself. Avoid spending money on brands and save money

For that, I would like to clarify some context. If we have to buy a car. But what are the criteria for buying a car? This is very important. About 1.5 years ago, when I bought my first car. Then I made a requirement list for it. And the cheapest car that fulfilled all these 4 – 5 requirements. I bought that. Could I buy an expensive car? Yes! I absolutely could.

But, I decided that my stature would not be determined by my car but by my work. People buy clothes and accessories. They hope that by wearing this, my respect in society will increase, and people will notice us. But, if you pay attention. So 1% of rich people in the world for example: Mukesh Ambani, Ratan Tata, Mark Zuckerberg, Elon Musk, Warren Buffet. Have you seen any of them wearing branded clothes? If you have money, then of course you will wear good clothes.

You will buy that item or watch which is useful for you. Just because it has a logo of a particular brand on it. You did not do this for the shirt. But you did it for the logo. Remember you create your own brand by your work. Not by wearing branded things. So instead of wasting money on branded things, focus on saving money.